Search Wars: The Future Of Search

Search and generative AI: a trillion dollar opportunity, generative art, blockchain bridges, leveraging customer research, funding rounds, jobs, events, and more

This newsletter is about startups and technology — with a Greek twist. Subscribe below for tech trends, startup advice, news, and jobs. Come aboard and join 4,263 others.

Find me on LinkedIn or Twitter,

-Alex

The AI revolution is here.

Last week, ChatGPT took the internet by storm. OpenAI, the famous startup/research lab released a free (for now) conversational interface, whose dialogue format makes it possible to “simulate dialogue, answer follow-up questions, admit mistakes, challenge incorrect premises and reject inappropriate requests”. It’s designed to mimic human-like conversation based on user prompts. Within a week, over a million users tried to make the tool talk and social media were filled with screenshots of chats between humans and a general-purpose chatbot with some degree of memory — arguably the most advanced we’ve seen to date.

The underlying model is GPT-3.5, a successor of the two-year-old GPT-3. An AI-powered, large-language model (LLM) that has ingested huge amounts of content from the web (175 billion parameters to be precise) and can generate natural text. This was perhaps the first to demonstrate that AI can write convincingly — if not perfectly — like a human.

GPT-x is yet another manifestation of how machines are just starting to get good at creative work. This new category is called “generative AI” meaning the machine is generating something new (text, audio, video, images, code, etc) rather than analyzing something that already exists. The advancements in generative AI present a point of disruption for multiple industries. Can they be a way to break Google’s hegemony on search engines? Today, we explore why the intersection of search and generative AI presents a trillion-dollar opportunity and why Google might miss out. I’m pleased to welcome Mark Tsirekas, VP Product at ZOE, back for a Startup Pirate guest post to take us through this fascinating space. You can follow Mark on Twitter and LinkedIn for more thoughts on AI's latest trends.

Handing over to Mark. Let’s get to it!

(parts of the above may or may not be written by ChatGPT)

Search Wars: The Future Of Search

Google search is one of the top engineering marvels of the 20th century.

Its business is one of the top industry-defining businesses of the century. Google is the true dominant name really in the category it helped invent. The rest of the players are inevitably and undoubtedly playing catch-up. And here comes the unfathomable: A new better search is needed and Google might not be the one to make it.

Yes, you read correctly and no, Google won’t lose in its own game. The question is whether it will be able to capitalize on the new wave. That which is driven by the needs of knowledge workers and the creative economy. One driven by digital skills as a means to productivity and the corporation’s appetite for paid productivity tools.

The trends are all there: an ever-connected globe of 5 billion connected devices. 45% of jobs are already being digitally enabled, driving more competition amongst firms than ever. An increasing flow of capital in productivity — 33% of unicorns in 2020 — is reported across all areas of work (email, design, notes, sheets).

There is soon going to be a new paradigm for search. It will be for businesses only at first, costly, exclusive, and a trillion-dollar business.

The next frontier in search

There are a few reasons why search innovation on the consumer side has not happened. First, no one can or wants to compete against Google. Second, the barrier to entry in search is very high. Third, search is currently “free” and works really well.

The thing is, it works really well for consumer use cases. Though all three were true till recently, we are now at a tipping point. But first, it’s important to examine what is the current and future opportunity in search.

The business of search & AdWords

Let’s start with the business of search. What does Google sell? It sells attention and corresponding leads in the form of keywords. In a way, Google AdWords is a marketplace. How are the keywords priced? Keywords are priced on a Cost Per Click (CPC) basis with the exact price calculated as a derivative of the sale. Google’s thinking is that since a customer made a purchase as a result of discovering the product or service from Google, then they deserve to be paid a fraction of that transaction. As a result, factors that pertain to the CPC cost are things like: the demand for the keyword, the probability of a user buying a service as a result of clicking on the keyword, and finally the cost of the service. A rough formula then appears for valuing a keyword:

Keyword cost = Demand competition x P(purchase) x Cost of service/good.

To exemplify what I mean consider this: For Google, “find a plumber” is more valuable than “How to find out if you have a leak” since the first is indicating intent and is thus more likely to result in a job, whereas the latter is merely an interest in a home issue. Following that logic, Google prices the former search phrase higher. From that lens, Google’s strategy becomes easier to understand: provide free knowledge and responses to all the non-commercial questions, so that users love it, and come back frequently so that when they do have a commercial query in mind, Google can monetize that.

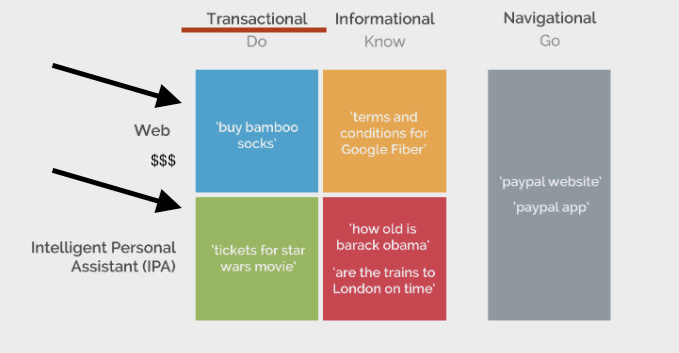

Whilst the amount of new questions people ask on Google tends to infinity, it turns out that they can conceptually be categorized into three broad types based on their commercial value. Here’s a nice illustration from Moz showcasing that.

There are three categories of search: Navigational, Informational, and Transactional. Navigational queries are the original use case of search and of low value to the business. Informational is what makes people love Google — and the basis of SEO nowadays. Transactional where Google makes the majority of its revenue.

While there are no public data on the distribution of revenue per category, it’d be logical to assume that transactional queries might contribute above 80% of the total ad revenue.

This leaves us with an interesting observation: Google’s incredible business model is leaving the majority of searches without monetization. In Google’s case, it is partly intentional. Free traffic (SEO) is the reason why companies comply with Google’s standards. This, in return, provides Google with better data, fewer problems to solve, and better monetization in transactional queries.

It’s also safe to assume that the more complicated the informational query, e.g. “what is the total valuation of online marketplaces” the fewer ads are likely to be targeting the phrase. Additionally, this is not an insignificant amount of traffic. Complicated queries inherently require more words in each search and according to Moz, this amounts to approximately 20% — in line with the percentage of people clicking on multiple results per query.

In other words, the answers to the complex informational queries that are powering the workers of the future are free, yet unattainable, unless one performs multiple searches, opens multiple tabs, and manually extracts the data points from each page.

GPT-3, Transformers & search v2

Enter GPT-3. GPT-3 is a search paradigm by OpenAI, launched in June 2020, and possibly the biggest threat to the status quo of search. Both Google and GPT-3 accept a string (a sequence of characters) as input, but while Google needs to return a relevant link, which hopefully will result in a paid click, GPT-3 is an API which merely returns a text-mashup of the most relevant information it has collated from the web and charges on a per call basis. GPT-3 is also able to generate answers for any symbolic query, not just words. An updated version of GPT-3 recently took the internet by storm with the launch of ChatGPT, a general-purpose chatbot and fine-tuned version of GPT-3.5. In the example below, it debugs code and returns the result to the user.

In doing so, GPT-3 does not need to worry about either transactions happening off the back of a search or owning the client. In fact, that’s not the purpose. GPT-3 is focusing on complicated informational queries. In doing so, it is breaking down the so tightly held barriers to entry in the search space. Additionally, GPT-3 provides a superior user experience to this growing segment of digital workers, who rely on information gathering and analysis to conduct their jobs. To understand why that is, consider the previous example of “what is the total valuation of online marketplaces”.

Google is not able (in its current form) to respond optimally to this query because it is designed to find the most relevant web resource, written by a human and surface it. However, this desirable answer to such a query requires gathering information from multiple sources and aggregating it all in one place. Today, this means opening up multiple tabs (some relevant, some not), reading through each post and manually stitching together the relevant information. This inherent limitation in the way the engine is built is the reason why Google’s 21% of search queries result in multiple open tabs. This is an effect we have never questioned because we didn’t have to. However, just as people don’t want a mortgage, they want a house, similarly, people are searching for an answer to their question, not multiple open tabs.

On the other hand, GPT-3 will aim to understand the intent behind the query, find all the marketplaces online, collate information about their valuation, and then return a complete response. The Google approach might take hours, whereas the GPT-3 search will take seconds and return a complete response. Apart from the argument of convenience, consider the difference this makes for an employer. This is not a step change. This is a game-changer. This is search v2.

The difference in terms of working hours is massive. And of course, this does not stop here. This revolution of search can be applied in any field which requires the user to research and collate information and each field will present different requirements. Search v2 will be vertical-first. Here are some other interesting use cases:

Sales: Return a list of all the names of Texas-based CEOs in companies with more than 200 people.

Education: Create a set of exercises to test a user’s knowledge of “Advanced computer architecture”.

Investment Analysts: Return a list of all London-based businesses with less than 10 people focusing on <you_name_it>.

The list of use cases is endless for someone with a little imagination and one thing is for sure; our kind is full of that.

However, the three use cases above all seem relevant in a corporate setting. There’s good reason to believe businesses will be the first customer for search v2. Under the current global context discussed above, they’re the most likely to perceive paying for a new kind of search as an “edge” rather than as an unnecessary expense. Additionally, and in accordance with the history of disruptive innovations, these revolutions start from “toy architectures”, niche use cases with limited capabilities. Businesses present the perfect starting point. Following recent updates to email, sheets, and the rest of the productivity tools, there are a few things we can expect:

A freemium version of such a search engine.

A product-led growth approach defined by low initial operational expenditure and healthy cash flows from day one.

Inherent product virality stemming from collaboration use cases.

User adoption that will move from (small) business to enterprise and finally to the general public similar to the desktop computer and unlike Facebook or Google.

And a true competitor to the latter. Here is another interesting thing to consider. If a company with a slick UX and good interactive design managed to persuade people to pay $30 per month for email (yes, Superhuman), what would a consulting firm be willing to pay for the new generation of its knowledge workers? The answer is simple: way more.

Google search yields about $59 per user globally. In fact, to better visualize how possible it would be to create a new trillion-dollar search business, consider that business search, search v2 is priced at $99 per month, or $1,188 per year, yielding 20x Google’s ARPU. For context, Microsoft Office business Premium is about $260 per annum per person, so 4x less but at full market penetration.

I guess the point I am circling around to is this: to reach Google’s 2021 $257bn in revenue, search v2 would not need 4.3bn users. It would only need 216m, or 1/5 people of the combined US & EU population or 1/4 people on LinkedIn. The combination of price and market penetration does not seem so crazy, since this means your work halving and productivity doubling. So, the next billion-dollar question is: who is going to reap the benefits of this?

The players in the search industry

Microsoft

Did you forget about Bing? In this new game, they’re not an outsider; rather they’re the dominant platform. There are a few reasons for that. First, Microsoft is a SaaS-first business and workplace is its bread and butter. Office, Teams and Outlook and search v2 make for a good combination. Second, they invested $1bn in OpeanAI, the business behind GPT-3. Additionally, they have the customer base and thus very effective distribution. Finally, Microsoft owns LinkedIn and GitHub. The former is conveniently the most powerful distribution mechanism to businesses while the latter provides an edge to Microsoft within the developer community should they decide to pursue a platform approach.

Google

This is definitely Google’s opportunity to miss. Google Cloud and its enterprise division are very well positioned in the space of productivity and Google can already power search v2. Additionally, many organizations rely on the search giant for Storage, Sheets, Docs & email which is also one of its fastest-growing segments. This could very well be another product offered as a premium tier of the gSuite or at least use the customer base of the division. The main issue here is that Google has to face the innovator’s dilemma: how to launch a product which is competitive with the cash cow?

Startups

With GPT-3 being offered as an API, this means that any startup can basically compete in the quest for dominating this new trillion-dollar industry. VCs have also shown a clear appetite for funding productivity and working on the future of search would be as sexy as it gets. This also makes sense since newcomers can have insights into specific use cases for business and enhance search with the necessary tools to make this a complete product for the industry. I feel inclined to highlight DuckDuckGo as a fit candidate as this approach would be completely in line with their privacy-first and, using GPT-3 as a basis for new search products, with their indie approach.

Conclusion? Brace yourself. Search v2 is coming. It will be the biggest business since Google and it’s up for grabs. The possibilities are endless.

Startup Jobs

Looking for your next career move? Check out 834 job openings from Greek startups hiring in Greece, abroad, and remotely.

News

Abu Dhabi's sovereign wealth fund ADQ, which manages $157b in assets, invested in Blueground to support the company's growth.

Generative AI startup, Runway, raised $50m for its next-gen creation suite for video editing.

ZOE, a startup that helps understand how food affects our bodies by analysing our unique gut, blood fat, and blood sugar responses, announced $30m in funding.

Not exactly Greek-founded per se, but a startup with half of the team based in Greece, Clerk raised a seed round of $6.2m led by a16z to expand its suite of authentication and user management tools.

Harbor Lab raised €6.1m seed led by VentureFriends and Speedinvest to make shipping dock easier and with less cost.

Kariera acquired Workathlon to further expand its HR tech offering.

Drones for linear infrastructure inspection and monitoring, Elythor, received a grant from Venture Kick.

Interesting Reads & Podcasts

Anastasis Germanidis, co-founder & CTO at RunwayML, discusses with Panos Papadopoulos, Partner at Marathon VC, about generative AI, Stable Diffusion, workflows for creatives, art, and what the future holds for this space, here.

Cross-chain bridges and a new era in blockchain interoperability by Georgios Gontikas, product & research at ChainSafe Systems, here.

A podcast with Demitris Memos, CEO of MarineTraffic, on his entrepreneurial journey and lessons learned from building Marine Traffic.

Maria Terzi, co-founder & CEO of Malloc, on overcoming challenges as an entrepreneur, here.

Leveraging customer research to make packaging and pricing decisions with Aggelos Mouzakitis, PLG & Pricing lead at Glofox, here.

Should managers act like therapists? by Zaharenia Atzitzikaki, Design Executive & Management Coach, here.

What would a Product Manager interview with ChatGPT look like? from Joseph Alvertis, Product leader, here.

Events

“December 2022 meetup” by Java Hellenic User Group on Dec 12

“Surviving a phishing attack in Cosmos-based chains” by Bitcoin & Blockchain Tech Meetup (Thessaloniki) on Dec 12

“Software testing & Next.js” by Larissa Developers Meetup on Dec 15

“WASM and Docker: Exploring the future of container technology” by Docker Athens on Dec 15

“19th WordPress meetup Larissa” by Larissa WordPress Meetup on Dec 17

If you’re new to Startup Pirate, you can subscribe below.

Thanks for reading and see you in two weeks!

P.S. if you’re enjoying this newsletter, share it with some friends or drop a like by clicking the buttons below ⤵️