Why Blockchain Matters

Living in a decentralised world with Metrika, Viva Wallet and JP Morgan deal, Facebook acquires Accusonus, acquisition of Pollfish, Marathon's €70m fund, jobs, and more

Happy Friday! Welcome to Hunting Greek Unicorns #46. I’m Alex, a product guy turned VC, and every two weeks I send out a newsletter with everything you need to know about the Greek startup industry.

If you find this interesting, you can share it with your friends or subscribe, if you haven’t already, and join 3,265 readers.

Why blockchain matters, living in a decentralised world, and driving adoption through reliability, with Nikos Andrikogiannopoulos & Dimosthenis Kaponis of Metrika

This week, I’m really excited to have Nikos Andrikogiannopoulos, founder & CEO of Metrika, and Dimosthenis Kaponis, CTO of Metrika, on Hunting Greek Unicorns to deep dive together into blockchain technology, discuss why it matters, where innovation is mostly coming from, decentralisation as a blockchain’s raison d’être, as well as how Metrika is helping drive adoption by defining a whole new field of operational intelligence for blockchain networks.

Metrika is an all-remote startup, HQ’ed in Boston with several team members working from Greece that has raised $18 million in funding and is already being used by popular blockchain networks such as Solana, Algorand, and more.

Let’s get to it!

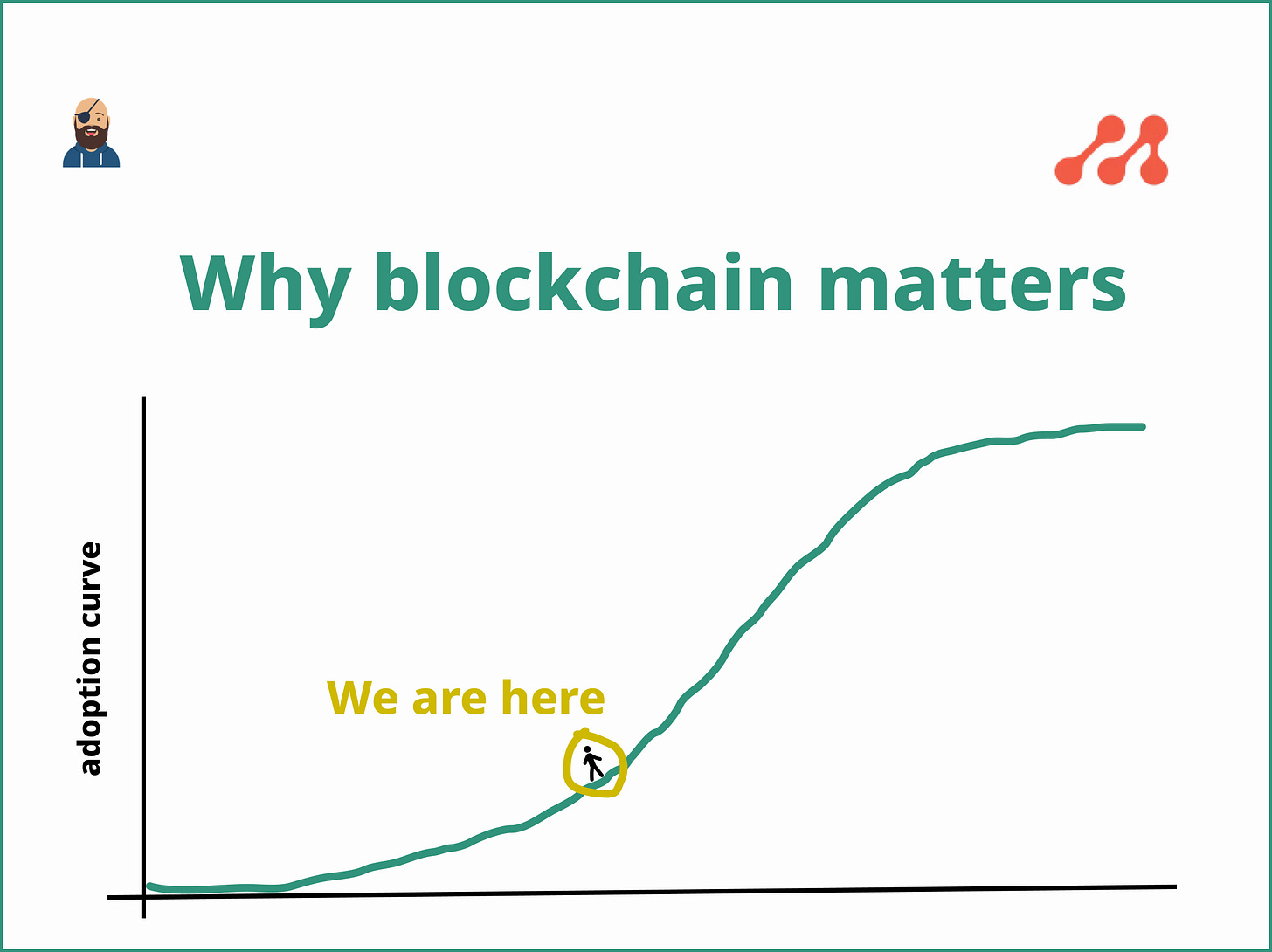

We’re currently going through a wave of innovation, a new tech adoption curve, which started with Bitcoin and is now expanding to more applications and use cases driven by blockchains. Why do blockchains matter?

Nikos: Blockchain is the latest wave of disruption that the internet has caused; disrupting today our banking system. If you go back to the 2000s, you will see the internet starting to disrupt several industries one after the other (advertising with Google/Facebook, e-commerce with Amazon, etc.). But the core of the economy - banking - remained largely untouched. Many tried. Paypal revolutionized payments with easier and less fraudulent online payments, neobanks improved the user (online) experience and offered simplified banking products. But nearly all of them scratched the surface since they relied, in the back, on traditional banking systems.

Though in 2009, Bitcoin appeared, supported by a community of anarchists, who wanted something different. It grew organically, totally outside of the traditional banking system. In its 13 years of existence, Bitcoin has proven that blockchain technology is unhackable and that people can trust the protocol for storing billions of value on it. Today, companies such as Tesla hold a portion of their balance sheet in Bitcoin. Following that, Ethereum added more functionality, with smart contracts and more digital assets (e.g. NFTs), expanding the capabilities of what a blockchain could do. You can now apply logic to how value gets distributed. And then stablecoins came around, removing the fear of volatility from people, who wanted to make transactions in crypto. Later, a number of faster blockchain protocols were also introduced, making transactions faster and adding more cool features.

We’re at a point where traditional banks see their customers holding digital assets (crypto, NFTs, etc.) outside the banking system and realize that they need to bring those assets back into traditional finance. My belief is that larger banks will manage to go through this digital (crypto) transformation, but smaller ones (regional, etc.) will not make it. In their place, new crypto banks will arise with brand new blockchain foundations.

This is why blockchain is important, it’s the innovation that is disrupting the core banking system, removing long-term structural inefficiencies, creating new assets that capture human effort in the digital age, and redefining modern finance with the community playing a much bigger role. And this crypto finance enables new possibilities for the web (aka web3), where systems and services can be built without the need for a controlling party (imagine a coffee shop as a decentralized organization without a boss/owner; everyone paying and getting paid in crypto, based on smart contracts). I think Richard Hendricks defines web3 perfectly in this video, “an internet that is of the people, by the people, and for the people .. so help me God!”.

Public vs. private blockchains — What are the key differences between them and where do you see innovation coming mostly from?

Dimosthenis: Public blockchains generally move much faster than private blockchains. The reasons are many, but two key differentiators are:

1. Public blockchains are working hard to build all-encompassing, futureproof, generic protocols at this stage, spending considerable time to plan, iterate and think strategically; this carries with it a lot of room for innovation. Add to that the fact that public blockchains have traditionally been tightly coupled to huge financial incentives (think crypto). This is where the most brilliant minds, most progress and most investment is. On the other hand, private blockchains typically start with an application first; this comes with considerable constraints, in both performance and operation, which significantly limits their ability to move forward. Another important aspect that underlines innovation in public blockchains is the role of the community, which, in addition to its contribution to the development of the protocols and ecosystems alike, is playing an important role in the decentralization of the networks and the organizations that run them.

2. Public blockchains have the scale necessary to surface challenges in protocol design and implementation, both pertaining to what Vitalik Buterin originally termed as the “Scalability Trilemma” (aka The Blockchain Trilemma) and specifically the extant issue of ensuring high performance while maintaining security and decentralization, and try to solve them. While private blockchains have certainly contributed to the state of the art, public blockchain networks are both where the most value is being created today and where innovation happens.

Vitalik Buterin, co-founder of Ethereum, wrote back in 2017: “Decentralization is one of the words that is used in the cryptoeconomics space the most frequently, and is often even viewed as a blockchain’s entire raison d’être, but it is also one of the words that is perhaps defined the most poorly”. How should we think about decentralisation and what are the key dimensions in the decentralisation spectrum?

Dimosthenis: Blockchain as a technology is expected to be “de facto decentralized”, in that the protocols themselves — if of sufficiently high quality — should enable trustless transactions with no single point of centralization. By trusting the mechanism, i.e. the protocol itself, participants can transact with each other, without explicitly trusting each other or the multitude of nodes participating in the network. This, to a considerable extent, removes the need for a broker or “trusted third party”, a radical departure from the status quo. That is not to say that gatekeepers and third parties do not have a role in blockchain-enabled applications; it’s just that their role is diminished compared to that of their counterparts in more traditional operating environments. It also means that the network is independent of any one operator. As blockchain grows, interoperability will play an important role and is a necessary enabler for its success as a technology (or more generally a platform). Somewhere along those lines lie the foundations of the whole “web3” concept.

Less related to the technology itself, but more of a consequence of it, Blockchain also introduces decentralization at the organizational level. Most blockchain protocol teams have set up accompanying foundations tasked with building their ecosystems and communities, as well as managing the evolution of the protocols and ecosystem. Governance of protocol development, investment, and standards has in many cases already started to be devolved to the communities themselves. This type of governance distributes power and gives third-party stakeholders and community members a say — something unheard of in established transactional platforms.

Can you share a bit more about what Metrika does and how it is addressing current challenges in the blockchain space?

Dimosthenis: Try to take a step back and think of modern, high-performance blockchain networks as “A Global Computer”. One main difference between this computer and existing computing paradigms, peer to peer, mainframe and terminals, on-premise systems, cloud-based systems, etc. is that, for the first time, we’ve got a multi-owner system, comprising hundreds of thousands of “components”, each owned by, literally, strangers. Much of the innovation around blockchain protocols focuses on turning this into a dependable, reliable, secure platform. What the protocols themselves cannot solve, is the need for all stakeholders involved to gauge the health and performance of this “Global Computer”. Existing monitoring, telemetry, and operational intelligence solutions were never built for such systems. They were built for single-owner infrastructure where it’s “easy” to understand the health of the systems involved. How do you achieve the same level of visibility in the case of a blockchain network? How do you identify issues? How do you enable stakeholders to resolve them?

Metrika is fundamentally attempting to answer those questions and in the process define a whole new field of operational intelligence for blockchain networks, giving stakeholders the assurance that not only their nodes, but the network as a whole, works as intended, as well as the means to diagnose and resolve issues when those arise.

What is the process by which you decide to work with a project?

Nikos: We care a lot about reliability and performance of blockchain networks. This gears us towards blockchain 3.0 protocols, i.e. protocols that came after proof-of-work (Bitcoin, Ethereum) and which have higher performance capabilities. These are the blockchain networks that produce sub-5 second blocks. This performance metric is important, because that enables enterprise applications to actually do things on blockchain networks. However, with performance and enterprise applications comes the need for service assurance, reliability and ability to know exactly what is going on with the health of the blockchain network at any given point in time. So, from our perspective, we care about “fast” blockchain networks with vibrant communities that are developing critical applications with high operational requirements. The size and level of activity of the community is equally important factor. These are the quality characteristics that we look for. Furthermore, one last factor is the quality of the protocol team that can work with us, as we build infrastructure in that ecosystem. Having a great feedback loop from the inventors themselves always helps with the quick evolution of our platform.

Who else is behind Metrika?

Nikos: Metrika is HQ’d in Cambridge, Massachusetts very close to MIT, which is where I’ve been living for the past 15 years. Our early investors include a number of notorious Boston-based entrepreneurs who have built and invested in some of the largest data communication companies in history. We have close ties to MIT since a number of us and our investors studied there. On some Wednesday nights, you might find a bunch of us joining blockchain meetups at MIT organized by various MIT blockchain clubs (last year we were actually one of the sponsors of the MIT Bitcoin Expo).

At the same time, we’re a global, all-remote team currently at 25 people and aggressively growing. Half of us are in the US and the other half in Europe (UK, Switzerland, Spain, Italy, Greece). Our strong link with Greece is my partner and CTO, Dimosthenis Kaponis as well as a number of our early engineers. We trust a lot the referrals we get from our networks (which naturally have a large Greek subgraph), so that leads us to hire some of the most talented Greek engineers. We think the talent that exists in Greece can flourish in the right culture and business environment. We’ve raised $18M in funding so far and our plans are to grow the team to ~40 people by the end of 2022.

Dimosthenis: Very early on we made the decision with Nikos to build Metrika as an all-remote company. Not because of Covid19, or because it was cool. We did it knowing full well what this means, both its advantages and the challenges it poses. At Metrika people are trusted, given autonomy, respect and their well-being and work-life balance are cherished, not scorned. People are evaluated based on their output, their ideas, their character. Not whether they stayed late one day to please their manager. Now, we’re not oblivious to some of the clear advantages of working together with people in the same space. Remote is tricky to nail and human interaction is essential. That’s why we also have bi-annual off-sites, where we all fly to a location (a different one each time!) and spend a week brainstorming, hacking, strategizing and thinking about the previous six months. Following in the footsteps of other, hugely successful, all-remote companies that paved the way, we also have an annual budget per team, allowing Metrikærs to meet in person for a few days, every few months, to brainstorm or refine projects or ideas together.

For most of our positions, we’re actively hiring across the USA, Canada, European Union and a few other countries (think EFTA/EEA) plus the UK. Greece is an important location for us, mostly due to the fact that several Metrikærs have ties to Greece and we have mostly grown organically to date. Following our $14M Series A round last summer, we’ve grown rapidly and will certainly continue to grow this year, as we extend our platform to support even more blockchain protocols, deeper analytics and Machine Learning.

If you want to learn more about Metrika, you can check out their website here.

Startup Jobs

Looking for your next opportunity? Check out job postings from Greek startups in Greece, abroad, and remotely. Company information is also available.

News

Some super exciting updates took place since my last email. In the past two weeks, we had a new unicorn valued close to $2b, Facebook acquiring a startup with plans to build a tech hub in the country, another startup being acquired by a US market research company, and more firepower in the industry to support Greek tech founders. Hunting Greek Unicorns game on! 🦄 🏴☠️ Let’s take a look.

JP Morgan acquired a 49% stake in Viva Wallet. Financial terms were not disclosed. Nevertheless, according to Reuters, Viva Wallet was valued at more than $2 billion.

Pollfish was acquired by Prodege, a US market research company. Big congrats to the whole team. You can check out the interview I did with John Papadakis, co-founder & CEO, exactly one year ago on how the team became product-first and unlocked the path to growth.

Although not officially announced, the word is out that Facebook (or Meta if you prefer) acquired Accusonus and is also planning to establish a tech hub in the country. You can find more details about the rumoured transaction, here.

At Marathon Venture Capital, we added more firepower to support the growing network of Greek tech founders around the globe, increasing our Fund II size to €70 million. Reach out if you're one of them.

Lendis raised an €80 million Series A round for its SaaS solution that helps companies set up and manage their employees’ equipment and software in the hybrid working world.

TileDB announced a strategic investment from Amgen Ventures to advance its universal database.

Pragma IoT raised €1m to build products in the low power computing and internet of things space.

GWI, a UK company with significant part of its team based in Greece, raised $180m Series B at $850m valuation for its market research SaaS.

Two Greek female-founded startups, Adadot and Kaedim, were #1 and #4 products of the day on ProductHunt last week. At the same time, Terra was in the top products of 2021 list, as Runner up under the Health & Fitness category.

Arcweave, a collaborative tool for game design, was selected for a grant by Epic Games.

Applications are open for startup accelerator, VentureGarden, as well as European Startup Universe Greece.

A list of the semifinalists of the 2022 MITEF Greece startup competition.

Startup Profiles

Interesting Reads & Podcasts

Influence, communication and managing teams and stakeholders as a Product Manager with Maria Arnaoutaki, Senior Product Manager at Spotify, here.

A post on the progress of the Greek startup industry and what comes ahead in 2022 by Sifted.

The evolution in the Market Research landscape by Andreas Vourkos, co-founder & COO of Pollfish.

New weekly podcast series co-hosted by Marily Nika, Product Lead at Google, deep diving into a new product every week with Roblox, TikTok and more in first episodes.

Konstantinos Giamalis, Chief Product Officer at efood, discussing his journey into product management, challenges growing efood, building product teams in Greece and more, here.

Maria Terzi, co-founder & CEO of Malloc, on her journey building a privacy and data security startup and thoughts on consumer privacy tech, here.

An interview with Panos Siozos, co-founder & CEO of LearnWorlds, on lessons learned building the company, the digitization of e-learning, education as an amazing form of marketing, and more.

A deep dive into multi-threading and multi-processing with Python and how they are related to concurrency and parallelism by Giorgos Myrianthous, Machine Learning Engineer at IQVIA, here.

Events

“San Francisco Greeks In Tech” by Marathon Venture Capital & General Catalyst on Feb 7

“A technical guide to raising a VC round” by Tech Finance Network on Feb 8

“API-first design approach with Stoplight” by Athens Laravel Meetup on Feb 15

Hot European Deals

This week, we are taking a look at some of the latest investments in the region of Southeast Europe.

Dream Games | Mobile gaming studio from Turkey raised $225m in a Series C round, now sitting at a $2.75b valuation

Fomo Games | Turkish gaming company raised $5m

EnterDAO | Bulgarian gaming and NFT DAO that raised a $1.8m investment

Treblle | Croatian SaaS tool for developers secured €1.2m

Hajde | Food and grocery delivery app service from Albania secured $1m

Kfactory | Romanian enterprise process automation for manufacturing raised €600k

How did you like this week’s Hunting Greek Unicorns? Your feedback helps me make this great.

Loved | Great | Good | Meh | Bad

You can also follow me on Twitter!

Thanks for reading and see you in two weeks 👋