The Flywheel of The Greek Startup Industry

Flywheels and data for Greek startups, jobs, news, a fund-of-funds, engineering levels, SEO and more

Happy Friday! Welcome to Hunting Greek Unicorns #24. I’m Alex, a product guy turned VC, and every two weeks I send out a newsletter with everything you need to know about the Greek startup industry.

If you find this newsletter interesting, consider sharing with your friends or subscribing if you haven’t already.

🚀 The flywheel of the Greek startup industry

The Greek startup industry is emerging and vibrant. It’s still early days; yet the progress throughout the past years is fascinating. In this post, I’m going to zoom out, look at the industry’s past ten-year journey and explain why it’s the right time to get more skin in the game (if you haven’t done already). To do this, I will rely on the power of flywheels and data (using the report Chris Gasteratos of Marathon Venture Capital recently published).

A startup scene is a system with many interacting parts: the peer group of founders, talent, Angels and VCs, set of social norms and policies; everything depends on each other. Though, three aspects stand out, as they can pretty much encompass the rest. They form a flywheel with three steps:

Startups growing and raising $$$

Startups getting acquired from larger tech companies

Successful founders investing in other founders

Back in 2013, when I joined a Greek startup for the first team, things were just starting up. Fast forward 7 years, the size of the industry is now of considerable size. There are way more people that have been through the trenches, raised money from top notch international and local investors and got acquired from larger tech companies. 2020 was an inflection year, as I described in a previous post, and things look even more promising for the upcoming years. I’ll explain why.

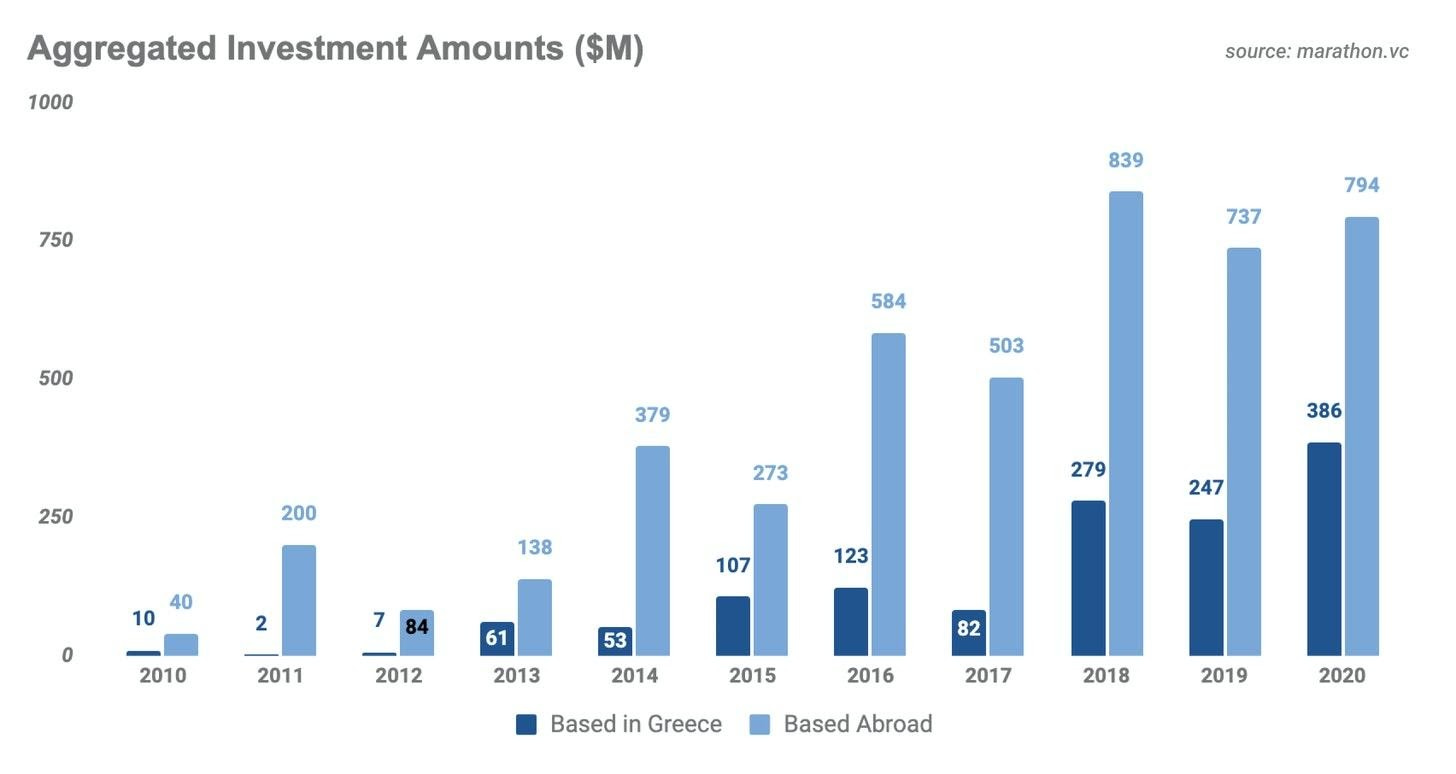

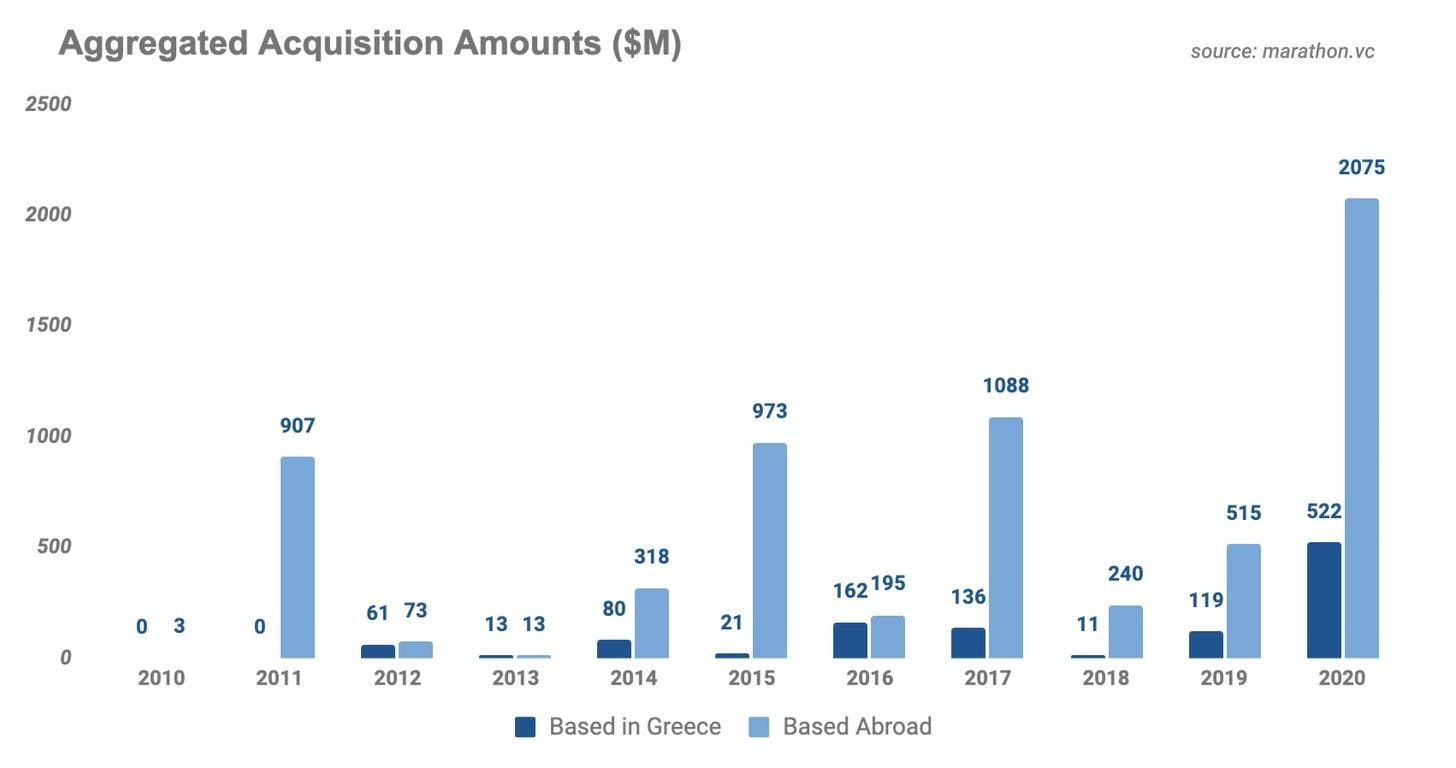

In 2020, $1.2B was invested in 124 startups with a Greek founder around the world and $2.6B were spent to acquire 14 of them. Inside the country, last year reached an all-time high with $386M in 56 investments (39x higher vs 2010) and $522M in 8 acquisitions (vs $0 in 2010). That, I call it up and to the right!

A growing # of startups raising an increasing amount of $$$

Investments have been growing steadily for startups with operations inside and outside Greece. Few people would have thought at the early 2010s that we’d see companies raising rounds of that size towards the end of the decade. Some examples with the total amounts raised: Viva Wallet (€96M - Series C in 2020), Netdata ($35M - Series A in 2019/2020), Blueground ($77M - Series B in 2019), Balena ($31M - Series B in 2019), Hellas Direct (€24M - Series C in 2019), Workable ($84M - Series C in 2018), Softomotive ($25M - Series A in 2018), Epignosis ($57M in 2017/2018), Persado ($66M - Series C in 2016). What is also particularly exciting is the increased activity in Series A and Growth (Series B +) stages. This is an evidence that more companies are maturing, employing more talent, and highlights the quality of recent cohorts.

Additional proof that the industry is maturing is the growing number of top notch international funds investing in Greek-founded teams: Bessemer Venture Partners (Shopify, LinkedIn, Pinterest) in Netdata, Index Ventures (Facebook, Slack, Skype) in Nova Credit, Trouva, PeoplePerHour, Onefinestay, Insight Partners (Twitter, Wix, DocuSign) in Epignosis, Balderton (Revolut, GoCardless) in Workable, 83North (JustEat, iZettle) in Workable, Lenses, Sequoia Capital (Apple, Airbnb, Paypal) in ActionIQ, Metanautix, Andreessen Horowitz (Facebook, Lyft, Zynga) in Matternet, Zumper, Khosla Ventures (DoorDash, Stripe) in Aisera and many more funds.

More startups getting acquired from larger tech companies

An important element in every startup scene is exits aka liquidity events, meaning acquisitions or IPOs. Why? First of all, because they show everyone what is possible. They set a high bar for people, forcing the community to think about growth. Moreover, they generate more angel investors and motivate the existing ones with FOMO. Exits are a lagging indicator compared to investments and it usually takes years to materialise.

Inside Greece, acquisitions have recently been on the rise. A handful of them in the beginning of 2010s have now led to a more consistent pace. Few recent examples: InstaShop (2020), Softomotive (2020), Think Silicon (2020), Helic (2019), Beat (2017), Innoetics (2017), Avocarrot (2016), Atypon (2016). In several cases, the acquirers have also expanded the local team, creating a much bigger hub in the country.

Some of the largest tech companies out there acquiring Greek-founded teams: Microsoft (Softomotive, Metanautix), DeliveryHero (InstaShop, eFood, Clickdelivery), Splunk (BugSense, Omnition), Samsung (Innoetics), Ansys (Helic), AppliedMaterials (Think Silicon), Daimler (Beat), Alibaba (Data Artisans), Facebook (Chainspace), Pinterest (Fleksy) and much more.

Equally important is watching startups getting large enough to become acquirers themselves, such as Skroutz, which acquired Everypay in 2020 and SendX in 2021.

Successful Greek founders investing in the next generation of Greek founders

Founders becoming Angels is probably one of the most essential parts in a vibrant tech ecosystem. They provide fast-moving, pre-institutional capital, as well as solid advice from people that have played the game before. It takes even more time to materialise and right now I think we’re at a point where we’re seeing more and more seeds cultivating.

A growing network of Greek founders around the world is investing, mentoring and supporting other Greek founders. With some digging on Crunchbase, here are a few instances:

Apostolos Apostolakis (eFood), Tasso Argyros (Aster Data), Yiannis Giokas (Crypteia Networks), Georgios Papadopoulos (Atypon), Panos Papadopoulos (BugSense), John Tsioris (InstaShop), Marco Veremis (Upstream), Alex Vratskides (Upstream), Demetrios Zoppos (Onefinestay), Argyris Zymnis (Adgrock) and others.

There are more of them (investing directly or through funds) and I’m sure we’ll see a substantially larger number in the years to come. Greek founders whose startups operate(d) abroad, investing in Greek founders whose startups operate inside the country is a testament of how everything is interconnected in a network of Greek founders and techies around the world.

I’m a big proponent of cultivating communities/networks of like-minded people and this resource that Chris put together with 557 Greek-founded startups around the world is golden. These are companies that have been funded and/or completed an exit since 2010. A great list to find teams operating in similar industries or locations, discover relevant founders and investors, female-led companies, analyze patterns, connect with like-minded people, etc.

Greek-founded teams inside and outside Greece are killing it! Investment and acquisition amounts are at an all-time high; top-tier funds are investing and big tech companies are repeatedly acquiring startups. A growing number of founders is investing and supporting other founders. We’re still a long way to go and this means many opportunities (financing, talent, founding, etc) are still up for grabs. Zooming out and seeing the current trajectory gives every right to feel things are just getting started.

🦄 Startup Jobs

Greek startups are hiring! Here are some of the latest job opportunities:

Blueground - Digital Design Intern (Athens) - Apply here

Digital Commerce Intelligence - Business Intelligence Analyst (Remote) - Apply here

Epignosis - Backend Engineer (Athens) - Apply here

Metrika - Senior Software Engineer in Test (Remote) - Apply here

Norbloc - QA Engineer (Remote) - Apply here

Signal Ocean - Data Scientist (Athens) - Apply here

Skroutz - Payroll Specialist (Athens) - Apply here

TGN - Talent Acquisition Manager & People Operations (Athens) - Apply here

TileDB - Site Reliability Engineer (Remote) - Apply here

Useberry - Business Development Manager (Athens) - Apply here

Workable - Customer Success Account Manager (Remote) - Apply here

👉 For more open roles check out the job board here, with 570 jobs from 89 companies

🗞️ News

A new fund-of-funds from the Hellenic Development Bank of Investments was announced, dedicated to financing startups. With initial size of €60M, AccelerateTT, will be deployed through VC funds for seed and technology transfer investments.

Stoferno, a groceries and last-mile delivery startup with operations in Athens, raised a €300K round from Lamda Development.

Numan, a men’s health startup headquartered in the UK with Greek founder and part of its team based in Greece, acquired the Swedish health company Vi-Health.

Better Origin, raised a $3M seed round led by Fly Ventures with Metavallon participating. The startup is building an autonomous insect mini-farm, helping farmers grow insects locally & sustainably.

Miroculus, a startup developing tools for personal lab automation, announced the completion of a Series B extension, bringing the total capital raised in this round to $45M.

Zymoscope, an IoT platform facilitating the monitoring of the fermentation processing with focus on the beer industry, raised a €960K seed round.

Financial Times published their annual list of 1000 Europe’s fastest-growing companies with several Greek startups making it in the list: Spotawheel, Dialectica, Workable, ConvertGroup.

Nikos Drandakis, founder of Beat, announced his new startup Sync on Substack some days ago. Sync is a biotracking product to help people improve their metabolic health.

Iasonas Kokkinos, co-founder of Ariel AI, the computer vision startup recently acquired by Snap, shared on LinkedIn how their technology already got integrated inside Snap’s creator platform.

Clio Muse Tours, a team in the audio & virtual tours space, was among the winners of the global startup competition by the United Nations World Tourism Organization.

The acceleration program ACEin has now opened applications for its next cohort until the 2nd of April.

💭 Reading or listening

The evolution of the Greek startup industry (investments & acquisitions) from 2010 to 2020 and full data for 557 Greek-founded startups that have been funded and/or completed an exit by Chris Gasteratos, Associate at Marathon Venture Capital.

The launch of Innovative Greeks took place this week with some great speakers including founders, investors and policymakers discussing about creating and funding innovative ventures in Greece. You can watch again Day1 and Day2 here.

A really nice intro on engineering levels from Andreas Nomikos, and his experience from Silicon Valley (ex-Uber, Facebook, LinkedIn & recently repatriated to Greece). Highly relevant for many startups that are now scaling their engineering teams.

Markos Tsirekas, founder of Timewith, on a product management view to SEO and marketplaces. Many SEO lessons here.

Jon Vlachogiannis, founder of AgentRisk, on the latest hype of NFTs (non-fungible tokens), what they are, how to buy one and trading them here.

Demetri Kofinas, host of Hidden Forces podcast, speaks with Balaji Srinivasan, former CTO of Coinbase & GP at a16z, on Silicon Valley’s ultimate exit, the rise of the network state and what this means for existing institutions.

A podcast with Maria Arnaoutaki, Senior Product Manager at Spotify, with Antonis Kalipetis and Paris Kasidiaris at Mikri Kouventa, on how she got into product, product leadership, collaboration challenges faced in a remote world, and much more.

Nikolaos Lygkonis, founder & CEO of PeopleGoal, sharing interesting thoughts at the intersection of HR and tech.

If you're into growth, Churn FM is a must-subscribe podcast from Cypriot in Tech Andrew Michael with an all-star group of past guests: Brian Balfour, Ryan Singer, Rahul Vohra and others.

I’d love to get your thoughts and feedback on Twitter or Facebook.

Stay safe and sane,

Greek Startup Pirate 👋