Building in Crypto

Discussion w/ Georgios Konstantopoulos - Paradigm CTO, Greeks in AI, cyber defence, storytelling for climate tech, jobs, events, and more

This is Startup Pirate #98, a writing about technology, entrepreneurship, and startups every two weeks. Made in Greece. If you haven’t subscribed, join 6,100 readers by clicking below:

Building in Crypto

Today, I'm really excited to introduce you to Georgios Konstantopoulos, CTO of Paradigm, to discuss building and investing in crypto and crypto's end game. Georgios has been one of the most influential people in the space, building for the past seven years and now leading open source development, research, and engineering for one of the largest crypto-related VC firms. Together, we're going to discuss:

how he got into the space

why building and investing in crypto are tightly interconnected

blockchain scaling and the state of Ethereum Layer 2s

Zero-Knowledge Proofs

the end game for crypto

surviving multiple boom and bust cycles

I'm new to crypto, where do I start?

Let's get to it.

Giorgo, thanks for joining me today. I'd love to hear your background story and how you got into crypto.

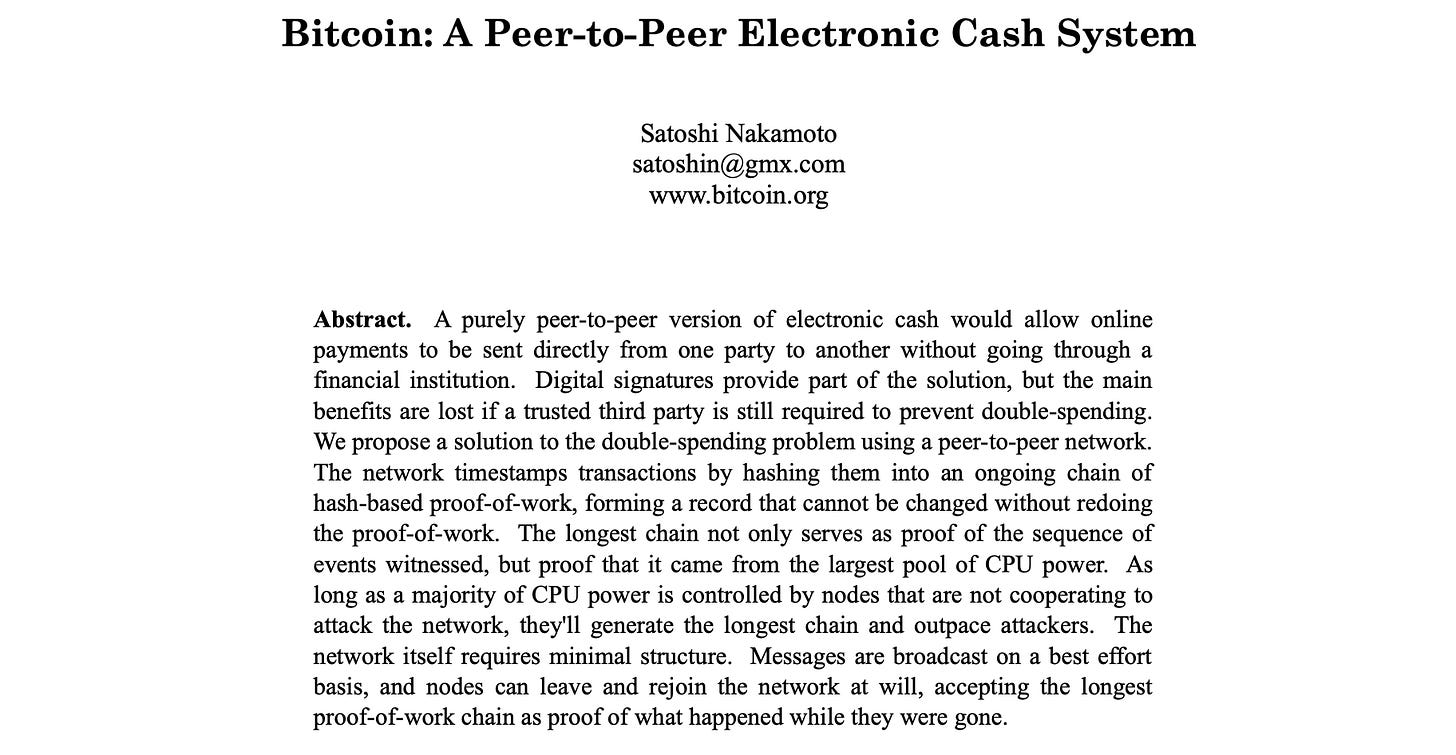

GK: I got into crypto as an engineering student at the Aristotle University of Thessaloniki. I used to run an information security and privacy study group teaching people how to hack. In one of our meetings, a guest asked us to do a presentation on Bitcoin. I downloaded the whitepaper and fell down the rabbit hole. That was March 2017.

A few months later, I interned at Honda, where they needed someone to research blockchain applications and develop smart contracts — my first full-time job in crypto. After Honda, I spent almost two years at a startup called Loom Network, where we developed the most popular crypto code school called Crypto Zombies, and then ended up doing research across the industry at the intersection of security, scalability, and interoperability: rollups, plasma state channels, and other scaling techniques.

When does Paradigm come into the picture?

GK: Throughout these years, I was presenting my research and consulting with various companies. Many of them were Paradigm portfolio companies. So, I was at a conference, and at some point, I ended up chatting with the founder of Paradigm, Matt Huang (who was at Sequoia before Paradigm). In July 2020, I joined the team as a Research Partner, focusing on open source development, research, and investing. About a year later, I started spending more time setting the firm's technical strategy and growing our internal engineering team, acting also as the CTO.

It's an interesting mix, investing and building, so I'd love to double-click here for a moment.

GK: Investing is about finding new companies and trends, meeting with entrepreneurs, and becoming their preferred partner, the first person they call when they have an interesting idea. That involves building relationships with people for years and meeting them before they even consider becoming entrepreneurs. On the other hand, building involves a lot of things. If we liken building to fishing, there are three broad categories:

You fish with the portfolio. You work hand in hand with them, writing papers, coding, and helping them succeed with hands-on support to their leadership and engineering. This means doing things that don't scale.

You teach people how to fish. We not only build with them but also install best practices into young engineering teams. In the case of Optimism, I wrote the go-to onboarding document for their engineers (a blog post on how rollups work). We also teach teams how to run companies, operational excellence, etc.

Fishing is good, and teaching fishing is better, but we cannot teach everyone. It's hard to scale that up when you want to impact the entire industry. Hence, we started building fishing gear like open source tools. For example, Foundry, the most popular testing toolkit for Ethereum application development (almost like the PyTest of crypto) and Reth, an Ethereum execution client. We believe that moves the entire industry. Every investor has capital to allocate, but the real value lies beyond that: going very hands-on and helping people succeed in a fast-changing, deeply technical, collaborative industry like crypto.

I know your research is mostly on scaling blockchains, so I'd love for you to give us an overview of scaling and why it's vital.

GK: Blockchains are useful because they don't have a central party running them. However, they achieve that by having everyone in the network replicate the activity happening. This means your system is as fast as your slowest participant. This is the curse of decentralisation, and different approaches exist to address that.

We can make faster blockchains with more efficient software. To some extent, this is Solana's strategy: You tune up the activity that the system can handle, and you still require everyone to rerun the state. This has the downside of sometimes lowering the system's decentralisation as fewer people can run it.

Since 2017, my research has been on how to scale on the edges, on Layer 2s, while keeping the core of the system very thin and easy to operate. That is how the Ethereum scaling culture works. Ethereum itself, as the Layer 1, is generally slow and can only handle 5-15 transactions/second, which is nowhere near any real scale. But we scale Ethereum's trust on Layer 2 through a technique called rollup. You should think of it as a fast path that can scale to 1,000 or more transactions/second and only share a summary of what has happened to the slower path that is Ethereum. Ethereum allows the existence of many of these Layer 2s to scale its throughput.

What's the state of Ethereum scaling today? Give us your sentiment check.

GK: Close to $40B is locked on Ethereum Layer 2s today, and we have about a 10x improvement in performance and fees relative to Layer 1. This performance is similar to what Solana can do but with an easier-to-decentralise architecture, which is better for the long run. It still remains to be seen which technique will win and what makes the most sense to do when.

We have been thinking a lot recently about the path dependency to success for a network. Let's say you have Solana vs. Ethereum. Solana has opted to be cheaper, acquire more users, and then try to make the network stable. It optimises for performance in the short term. On the other hand, Ethereum's approach was first to make it very stable and then carefully add more capacity as demand arrives. I think both approaches are credible, and it's interesting to watch them evolve and see what's best in the long run. Nevertheless, it's possible that they will coexist as the market will be so big and different approaches will exist simultaneously.

What about scaling Bitcoin?

GK: That's a good question. Scaling Bitcoin has historically been harder just because of the limitations of its scripting language. It allows very simple computation on the blockchain because we don't want it to be used for crazy stuff or get hacked. What worked in the past was Lightning Network, the dominant scaling technique which only supported payments. More recently, however, there has been a resurgence of interest in Bitcoin Layer 2s. This might require some protocol-level changes. Therefore, I believe that even though it's very exciting as the blockchain has a lot of assets on top of it, we are still in this weird intermediate spot where nothing is really happening yet.

What other areas apart from scaling are you most excited about now?

GK: The general field of math called Zero-Knowledge Proofs (ZKPs) is very interesting. It's "moon math", involving cryptography, probabilities, and statistics. ZKPs let someone prove that they know or have something without giving up any information about what they know or have. For instance, you can prove you know the password to an account without entering the password and risking its exposure. Or you can convince someone there's $X in your bank account so you can rent an apartment without the other person having to look at your account.

You don't need blockchains to introduce ZKPs, so this has a lot of implications in the real world, too. There are many use cases, but one that excites me is fixing deepfakes. Everyone can use OpenAI's DALL-E to generate an image. With ZKPs, you can verify that a synthetic asset came from a specific AI model, allowing the world to know what's real. All in all, ZKPs can be used not only for privacy but also to verify the validity of transactions on blockchains, which is why they are already being used in several Layer 2s.

Are there any non-financial use cases that make sense for crypto in the long run?

GK: It's important to recognise how blockchain fees select for use cases. The more fees go down, the more use cases open up. If you look at the history of crypto, we started with Bitcoin. Fees were high, and there was little to do other than perhaps buy and hold. Then, there was Ethereum. Fees dropped a little, and we got programmability through decentralised exchanges, speculation, etc. But now, especially with Layer 2s, fees are becoming less than a cent, and latency consistency is sub-second. We left behind the progress bar UX era and are now in the era of the loading spinner.

Hence, we can now have usable consumer applications such as Farcaster, a decentralised Twitter alternative, or on-chain games, which let you port assets across games and compose with others. It's early to see what use cases will work in the long run, but the point that fees select for use cases is critical.

What do you see as the end game for crypto?

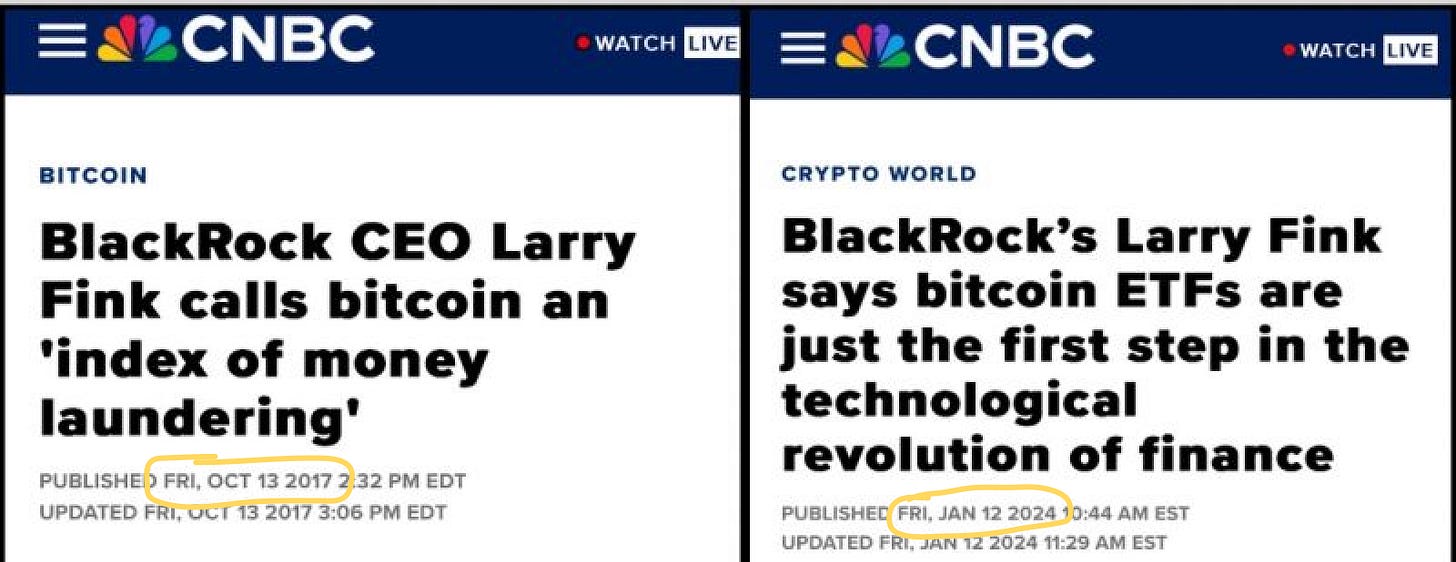

GK: On a global scale, crypto has already changed the world. Even if Bitcoin just existed as money, and that was the only use case of crypto, it's already very valuable. It's a global monetary asset that everyone can own and is now embraced by BlackRock, Fidelity, and the largest asset managers. BlackRock's CEO used to call Bitcoin a scam, but now he says it's larger than any government. Then, if you look at decentralised finance, Uniswap has settled >1 trillions dollars, with minimal maintenance, as an unstoppable app. That's really powerful for global finance, which is plagued by high fees, slow transactions, and a lack of transparency.

The jury is still out about the whole premise of the decentralised web. Still, we are finally on the cusp of fees being low enough to actually experiment with it.

Fred Ehrsam wrote a post on “Surviving Crypto Cycles” some time ago. What is it like being in an industry with big boom and bust cycles every few years, and how do you motivate your team to stay on track?

GK: If somebody's motivation to work in crypto is based on the price of Bitcoin, they're probably not a fit for the team I want to operate in. If you're here to change the world, you have to be willing to zoom out and think across market cycles. Then the question is, how do you put that motivation to good use? By focusing on building during the bear markets when tourists have left. This is when the best work, investments, and technologies have historically happened, and the people who care about moving the needle stay and persevere. I've been in crypto for seven years and have seen multiple market cycles. The most important thing is not to blow up, continue to build for as long as you can, and grow as the sector grows.

How would you advise a young kid who wants to get into crypto? Where would the 18-year-old Giorgos start from?

GK: I have worked with several under-18-year-old kids on the Paradigm team or the Reth project. We generally like to have people in crypto very early in their careers. It's interesting to understand why. People don't break into machine learning when they're 12 or 13 because they need massive GPUs or PhDs in NLP. Crypto is truly egalitarian and has a very low barrier to entry field because it's all open source. Open source sits at the core of crypto.

A great starting point is understanding crypto's value to society and seeing if it rings with you. Read the Bitcoin whitepaper and watch Andreas Antonopoulos' videos on YouTube. It's really a rabbit hole and requires proper time investment. People in the space are collaborative by design because it's such an early, nascent field, so I'm sure if someone has the right motivation, they will find ways to thrive in the field.

Learned a ton today, Giorgo! Thank you.

GK: Thanks, Alex.

Jobs

Check out job openings here from startups hiring in Greece.

News

A few months ago, I highlighted how a significant % of top papers in NeurIPS — the #1 AI conference — were co-authored by Greek scientists (10%, to be precise). This week, in ICLR, the #2 AI conference based on h5-index, you can find Greek scientists once again in 10% of the top papers (selected for oral presentation). Here’s the full list if you want to dive deeper. Plenty of them are NTUA graduates, so the university’s high standing in employability rankings and career options for grads (17% pursuing PhD) should come as no surprise.

AI defense company and Marathon-backed Lambda Automata acquired Smart Flying Machines, a manufacturer of autonomous aerial vehicles.

Sustainable fuels producer LanzaJet announced an investment from Microsoft's Climate Innovation Fund.

Insurance company Hellas Direct raised funding from 5G Ventures.

RetinAI announced a $6.18m Series A to advance AI healthcare solutions.

AI customer operations Gradient Labs raised funding from Local Globe.

SmartLoC (supply-chain tech) and Caroo (car-sharing) are the first investments of the newly formed Greek VC Loggerhead Ventures.

More capital available for Greek startups with two new funds.

Resources

Predictions about the future of AI and what's possible with the current paradigm with Athanasios Vlontzos, Research Scientist at Spotify.

Brand narrative and storytelling in Climate tech by Art Lapinsch, Founder at Delphi Zero.

Running a company with three CEOs by Konstantinos Mouzakis, co-CEO at Balena.

Learn how to learn by Vagelis Koutkias, Engineering Manager at Datoptron.

Evaluating scalar quantization in Elasticsearch by Thanos Papaoikonomou, NLP Applied Scientist at Elastic.

CI/CD Observability: a rich new opportunity for OpenTelemetry by Dimitris Sotirakis, Senior Software Engineer at Grafana Labs.

SEO and AI: blocking crawlers from websites by Stavros Theodoratos, Director Digital Acquisition at Public.

AI for Cyber Defence with Vasilios Mavroudis, Principal Research Scientist at The Alan Turing Institute.

Scheduling jobs with priority aging by Markos Fragkakis, Staff Engineer at Workable.

Decoding the EU AI Act with Stefania Diamantara, Director of Legal & Compliance at Dialectica.

Events

API Athens #B2 on May 14

Angular Athens 22nd Meetup on May 14

Greeking Out in London on May 15

START your night UP on May 15

Pitching to investors on May 22

DevOops Athens #1 on May 28

Bosch Bytes Athens on May 29

ProductTank Athens #6 on May 29

MoT Athens #13: Web3 Testing & APIs for Browser Automation on May 30

1st Athens Causal Data Science on May 30

That’s all for this week. Tap the heart ❤️ below if you liked this piece — it helps me understand which themes you like best and what I should do more.

Find me on LinkedIn or Twitter.

Thank you for reading,

Alex